Some links included here may be affiliate links, meaning we may earn a small monetary bonus from referring you to them. In no way does this increase the price you pay.

Invoicing software can make life so much easier, especially when you’re just getting started. You’re not very polished with your approach and onboarding style, so the last thing you need is to send over an Excel template invoice and ask them to mail you a check.

When I got my first client, I was so excited when they said “yes” to working with me. I had sent them a proposal, decided on a price (that I literally pulled out of thin air), and then the question came: =

“So you’ll send me over an invoice? Or how can I pay you?”

Uhh…..

“Yep, I’ll send an invoice today.”

It was one of those typical entrepreneurial times where you’ll just commit to figuring it out.

But sending invoices to clients was one of the major problems I ran into once I had my first client. People wanted my services, but I had no idea how to let them pay me!

It took a lot of research and cobbling together things before I was able to make it work.

I wanted to help you avoid that panic and following frustration of trying to figure this out as a newbie. So here are a some examples of invoicing software you can use to get paid.

Best Invoicing Software

1. Quickbooks

This is my current accounting software and I love how it works. It’s easy to use, there is a lot of data you can look through, and it just works.

I’ve been using it for around 3 years now, here is my Quickbooks review.

One of the things I love about Quickbooks is that their fee structure for accepting your customers payment is simple.

Payment Fees:

- 2.9% + $0.25 per transaction

- Bank Transfer of Debit Card – FREE

Yes, you read that right – F-R-E-E

Of course, not all clients will be able to pay that way, but it’s my default option for now unless someone writes back and says they need a credit card option.

Quickbooks gives you a simple invoice template to use that includes all the necessary items you need on there:

- Invoice number

- Customer name and email

- Their company address

- Your business name, email and business address, contact information

- Your logo and phone number

- Items

- Price

Plus there is room for a brief message to the client on the invoice if you need it. Once you go to send the invoice, you can customize the invoice email as well.

If you’ve been reading along, this is where I add my message about having a referral program.

They also make it easy to set up recurring invoices for those customers you have on retainer and need to take payments from each month.

While there is a fee to use the platform, it’s for more than just send invoices to clients. You can take a payment, track your hours and mileage, track your expenses and run a profit and loss statement.

If you’re billing out more than $1,000 per month, you’ll want to look into Quickbooks as its free bank transfers will save you more money than the software costs compared to other options.

From inventory and invoices, to projects and people, QuickBooks organizes it all in one place.

- Track Income and Expenses

- Invoice Clients

- Mileage Tracking

Users save an average of 42 hours per month with QuickBooks.

2. Freshbooks

Freshbooks is a popular platform among freelancers, contractors, and business owners. You’ve probably heard more than a few commercials from them lately as they’ve grown a lot.

- Fees:

- 2.9% + $0.30 per transaction (for sales within the US)

- 2.9% + $0.30 + 1% (international fees)

If you are lucky enough to get with Freshbooks Classic, you also get the option of using PayPal for Business, which is only a $0.50 transaction fee.

The money takes forever to get to you, but again if you’re saving hundreds in fees, it’s probably worth it.

I really like how you set up invoices with Freshbooks invoice generator. The process is super simple and doesn’t seem as “stuffy” as some other platforms do – it’s kind of fun to use. You can also customize the invoice email that customers receive as well.

If you have questions about their invoice generator, there is always a chat icon in the bottom right corner to help you out.

Freshbooks is an invoicing and accounting software that works well for freelancers and those just getting started. It's an easy to setup tool that allows you to take payments, send invoices, track time, and manage your business finances.

3. Zoho Invoice

Zoho Invoice is another great option you can use to get started. They have a free plan, but also more feature-rich plans to grow into as your business grows.

Zoho is more notably known for being a CRM tool, but they started offer invoicing software that links to their CRM.

Their free plan accommodates invoicing up to 5 customers, but once you start getting more clients, you’ll need to upgrade to one of their higher-tiered plans, which range from $9/mo to $29/month. These plants mainly differ based on the number of invoices you’re sending each month and if you need to allow more users.

Zoho Invoice is a billing and invoicing software for small businesses, which means you can take payments and send invoices to customers easily. You can accept credit card payments as well as bank account transfers.

Like Quickbooks and Freshbooks, their platform includes a ton of other features like time tracking, creating estimates, taking payments, send recurring invoices, and scanning receipts for your expenses to make them easier to track.

Plus, you can buy credits to send invoices via snail mail as well, which is still the standard for a lot of local businesses.

Zoho invoice in an invoicing software that allows you to track payments, send estimates, track your expenses, and more. While they have paid plans, you can get started for free and invoice up to 5 clients.

4. Paypal

One of the more common choices you can use to invoice clients is Paypal. You can set up a business account and send invoices as well as take a payment.

Paypal is great for getting started because it’s quick and easy to setup and get an invoice sent out.

However, once you get more established, this isn’t going to be the ideal solution for you.

Fees:

- Credit Cards: 2.9% + $0.30 per transaction (for sales within the US)

- 4.4% + fixed fee based on currency received (for international sales)

You might be tempted to use the friends and family option to avoid fees, but if PayPal determines you are incorrectly using the accounts you could get shut down.

Also, Paypal and these other platforms (like Quickbooks) are great because they send out the proper tax documents for you at the end of the year, so using this software to invoice clients means you wont have to file the right tax forms for each person who pays you more than $500 per year.

5. Stripe

Stripe is a payment processor, not a full-blown invoicing system. However, they are one of the industry leaders in payment processing, so they are not to be ignored.

You can still set up invoices, they just might not look as professional and “tidy” as one that comes from Quickbooks or another platform.

While PayPal only allows credit or Paypal payment, Stripe also offers ACH (bank transfer) payments, which can significantly reduce the fees you’ll pay.

Fees:

Credit Cards: 2.9% + $0.30 per transaction (for sales within the US)

- 2.9% + $0.30 + 1% (international fees)

ACH (Bank Transfer): 0.8% fee (capped at $5 per transaction)

That ACH charge is very minimal when you consider if you’re taking thousands of dollars in payments each month.

Free Invoicing Software:

6. Wave Accounting

Wave is a little more advanced of these free tools and is the one I’ve used the most on this list. They keep track of your invoices, send out recurring invoices, send reminders to clients who haven’t paid yet, etc.

This is the one I’d recommend for anyone getting started, because Wave invoicing is free to use.

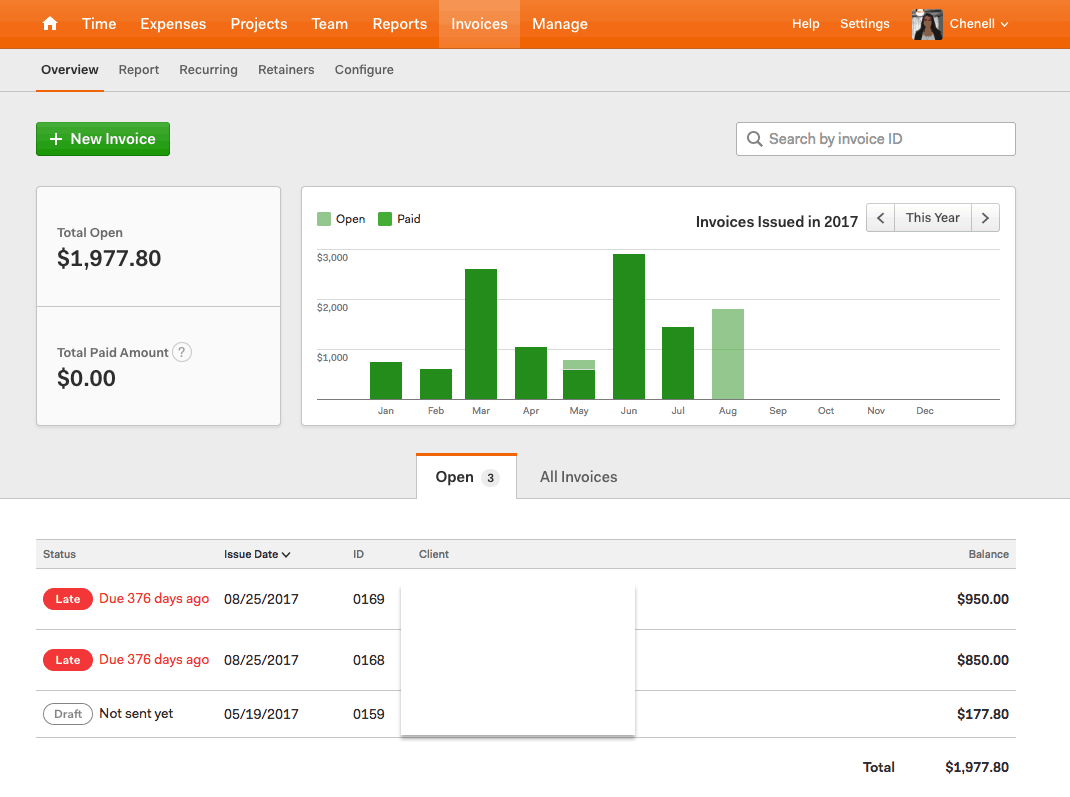

Here is what the Wave dashboard *used to* look like, it helps you keep an eye on what money is coming in, how much you’ve made over the last few months, etc.

I used Wave invoicing for about a year and loved the experience, it was just time to migrate to Quickbooks for me because my accountant wanted to have a more robust system setup.

The invoices from Wave look very similar to what you’ll find with many of the other tools on this list.

I used to love Wave, and will always recommend it to new freelancers because of the features they offer and how easy it is to send an invoice with their invoice generator and accept payments.

They also have the handy dashboard that shows you profit, loss, and keeps you updated if someone hasn’t paid on time and needs a little “nudge”.

As a new freelancer or someone just getting started, you can’t go wrong with Wave apps as an invoicing app.

7. Harvest

Harvest is primarily a platform for time tracking your projects, seemingly targeted at web design businesses and creatives. However, it has a great invoice software for beginners of all kinds of other businesses.

Harvest doesn’t actually take payments from your customers, so you will need to use Paypal or Stripe to accept payments – but they have integrations, so it is a seamless experience for your customer, and quite easy to setup.

Fees: Uses Stripe and/or PayPal to take payments (see below). That is the only fee you’ll pay (with the free Harvest account).

It’s the one I initially started with after I took a couple payments because I didn’t like Paypal. Plus, they had this handy dashboard that showed your month over month income, which I loved.

What to Include on an Invoice

If you’re going to the super DIY route and want to just send paper invoices or create something with Google Docs, here are the main things to include in your invoice templates:

- Your Logo

- Your Name

- Your Business Name

- Your Company Address & Phone Number

- Your Email Address

- Customer Name

- Customer Address & Phone Number

- Customer Email Address

- The type of product or service you’re selling them

- The cost of the service

- If you’re charging by the hour, include the cost per hour, number of hours, and total cost

- Invoice date

- Due Date

- Invoice Number – you can make this up, but I’d recommend starting with something besides 001 because it makes you look like a newbie to this customer 🙂

Once you have the invoice template set up, make sure you let them know how they can pay you in the invoice email you send over. And that’s it, you’re ready to send an invoice!

What Invoicing Software Should You Use?

I think you can see from the tools above, that using a billing and invoicing software doesn’t have to be hard or cost a ton of money.

If you’re just getting started as a freelancer or contractor, you can’t go wrong with Harvest or Wave. But, it’s a pain to move away from Harvest when you do want a more robust system, so if you know you’re going to be at this for a little while, I’d recommend starting with Freshbooks or Quickbooks.

If you’re making more than $1,000 a month, every single month, I’d probably recommend moving right into Quickbooks. Sure, there’s a monthly fee for the service, but if you’re client is paying you $1,000+ via bank account transfer, you’re saving ~$29, so it offsets the cost.

I really hesitate telling someone who is just starting to add a monthly bill to their balance sheet, but you’re actually saving money as long as you have that income coming in AND you know your customers will pay via bank account payments and not want to use a credit card.

You are getting the service for free essentially, and get to use the other great features it has, like keeping a better grasp on your accounting and books.

I have Wave for my invoicing for close to a year now and I can’t imagine moving to another app. It’s a lifesaver, in terms of money you would otherwise spend on an accountant or QuickBooks-like app. The fact that Wave is free makes it more appealing to me as a freelancer.

Me too, but I just moved to Quickbooks 3 weeks ago. I agree that Wave is such a great option for freelancers – however, if you invoice out more than $1,000 a month, Quickbooks pays for itself with free ACH transfers. You actually make money back by paying for the tool, so check it out if you invoice out more than that.

I see. Some months I do go beyond $1000 even though freelancing is a side gig. I will surely check it out. I think it’s been years since I used QB, so I might need a brush up too. Thanks.

Congrats on making that much extra money on the side! 🙂 Let me know if you check out Quickbooks and have any questions. I’m still new to it but am learning quickly!

I’m not sure if you have tried it, I’m still in the “setup and get customers” phase, but decided to read this article anyway just kinda trying to stay ahead of the game, but what are your thoughts if any on Google Pay? that’s the site if you haven’t looked at it before, it’s free to customers to pay you and it’s certainly got my interest as it’s completely free. Also any way you think you can integrate a non-supported payment service with invoicing?